Photoshop Won't Let Me Save

Walt Disney (DIS) - Get Walt Disney Company Report was rising almost 2% Tuesday ahead of the company's earnings report after the close of trading.

Investors will be watching this one closely. Like Netflix (NFLX) - Get Netflix, Inc. (NFLX) Report, Disney+ has already seen a large uptick in subscribers. In fact, the platform has already logged more than 50 million subs.

That will be the focus when the company reports earnings. That's as the rest of its business - theme parks, studio and network revenue - have been severely impacted by the coronavirus.

So far, Disney stock has had a solid bounce from the lows. Earnings can be a volatile event and if investors are disappointed the rally over the past month has the potential to give way to a pullback.

TheStreet Recommends

Let's take a closer look at the charts.

Disney is a holding in Jim Cramer's Action Alerts PLUS member club . Want to be alerted before Jim Cramer buys or sells DIS? Learn more now.

Trading Disney Stock

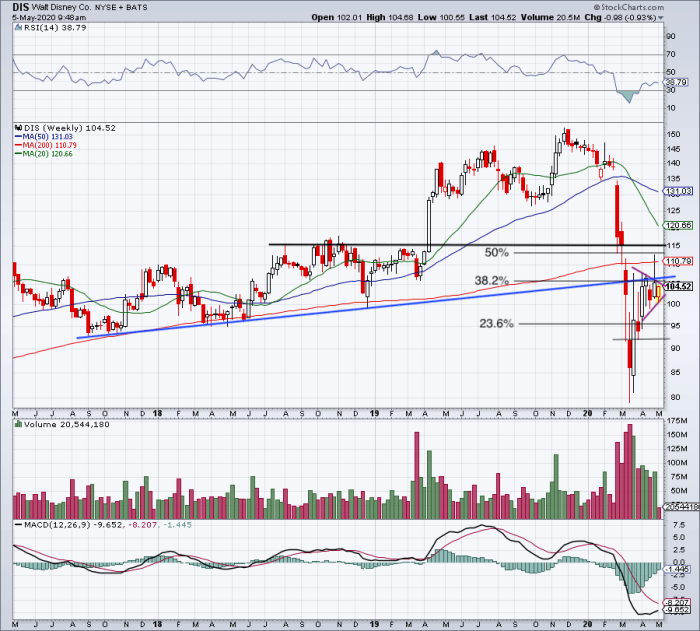

Weekly chart of Disney stock.

Chart courtesy of Stockcharts.com

When Netflix reported earnings last month, the stock had recently hit new all-time highs. Despite a stellar quarter of subscriber growth though, the stock has pulled back.

While Disney stock is still well off its highs, the fear here is the same. That is, a sell-the-news reaction to its earnings. That said, the stock is at an interesting spot on the chart.

Shares are coiling directly beneath long-term uptrend support (blue line), as well as the 38.2% retracement for the 2020 range. At the same time, shares are forming a tightening trading range — a wedge — ahead of earnings.

It's likely that the report will thrust Disney stock out of this formation. We just don't know if it will be higher or lower.

If it's higher, look for DIS stock to rally to the 200-week moving average, a mark that rejected it in April. Above that puts the 50% retracement in play near $113, as well as the multi-year breakout mark near $115.

Over $115 and bulls will be firmly in control of Disney shares. This is a big area to keep an eye on.

If the break is lower, I would like to see Disney hold the 23.6% retracement near $95, as well as the $92-ish area, which was significant amid the March pullback. Below puts $85 in play.

Keep these levels in mind once Disney opens for trading on Wednesday. Beyond that though, they're likely to play a role for days, weeks and possibly months from now.

Photoshop Won't Let Me Save

Source: https://www.thestreet.com/investing/disney-dis-stock-streaming-earnings-preview

Posted by: mooretaks1965.blogspot.com

0 Response to "Photoshop Won't Let Me Save"

Post a Comment